Table Of Content

- A Complete Guide to Capital Gains Tax on Real Estate Sales

- The Basics of Calculating Your Tax

- Capital gains tax on a primary home

- How the home sale tax exemption works

- Avoiding capital gains tax on a rental or additional property

- What Is The Real Estate Gift Tax And How Can I Avoid It?

- Frequently Asked Question Subcategories for Capital Gains, Losses, and Sale of Home

For gains exceeding these thresholds, capital gains rates are applied. You can’t deduct the losses on a primary residence, nor can you treat it as a capital loss on your taxes. You may be able to do so, however, on investment property or rental property.

A Complete Guide to Capital Gains Tax on Real Estate Sales

If you own and have lived in your home for two of the last five years, you can exclude up to $250,000 ($500,000 for married people filing jointly) of the gain from taxes. Homeowners often convert their vacation homes to rental properties when they are not using them. The income generated from the rental can cover the mortgage and other maintenance expenses. If the vacation home is rented out for fewer than 15 days, the income is not reportable.

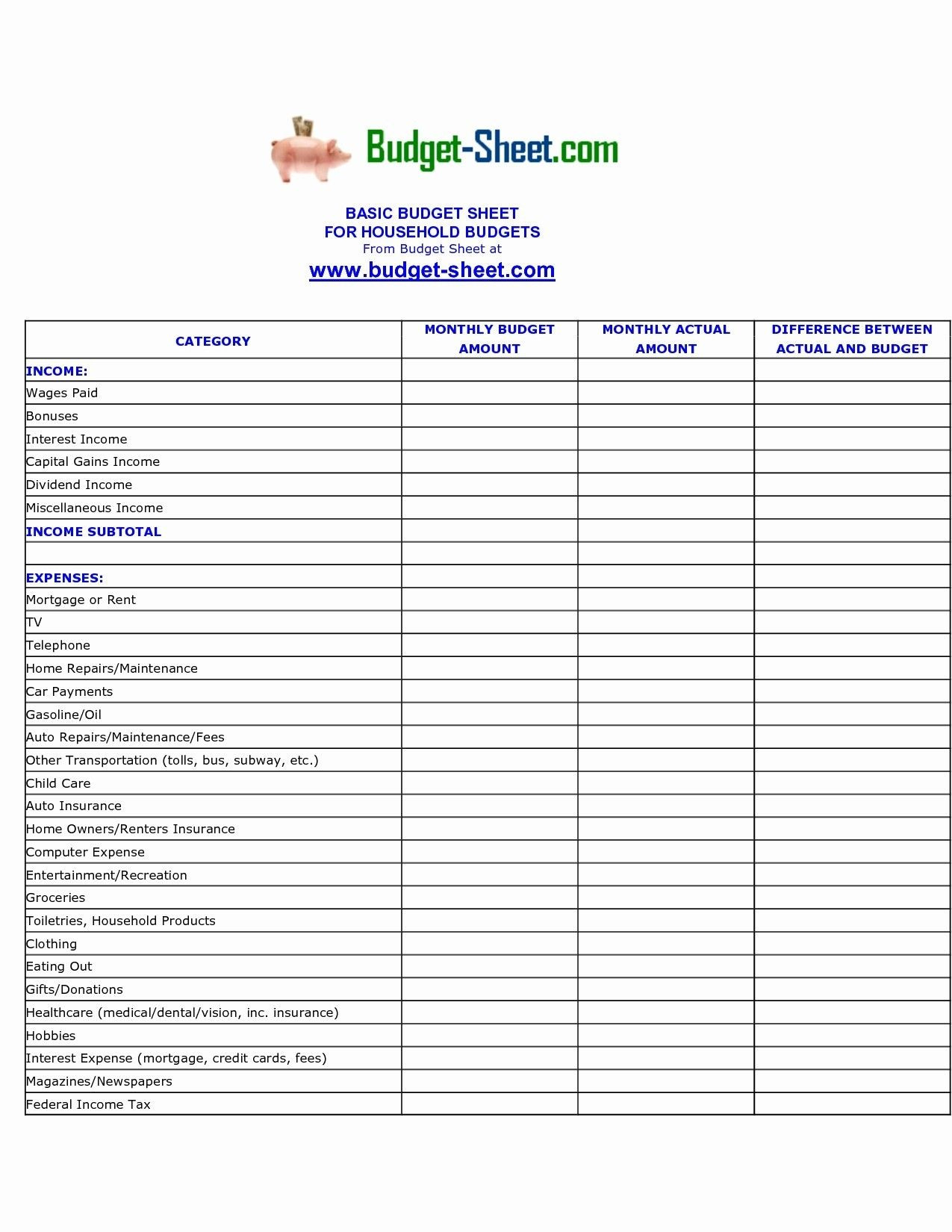

The Basics of Calculating Your Tax

According to the IRS, the average taxpayer will probably fall into the 15% capital gains tax bracket. That being said, capital gains rates can run as high as 20% on real estate transactions. Because capital gains can only be assessed when an investment is sold, you pay this tax when selling property to another party. It’s not part of your monthly mortgage payments like property tax. And even though it’s applicable when selling a home, you don’t pay this tax as part of your closing costs. However, the next time tax season rolls around, you’ll need to report your home sale to the IRS and pay whatever taxes you owe on the property.

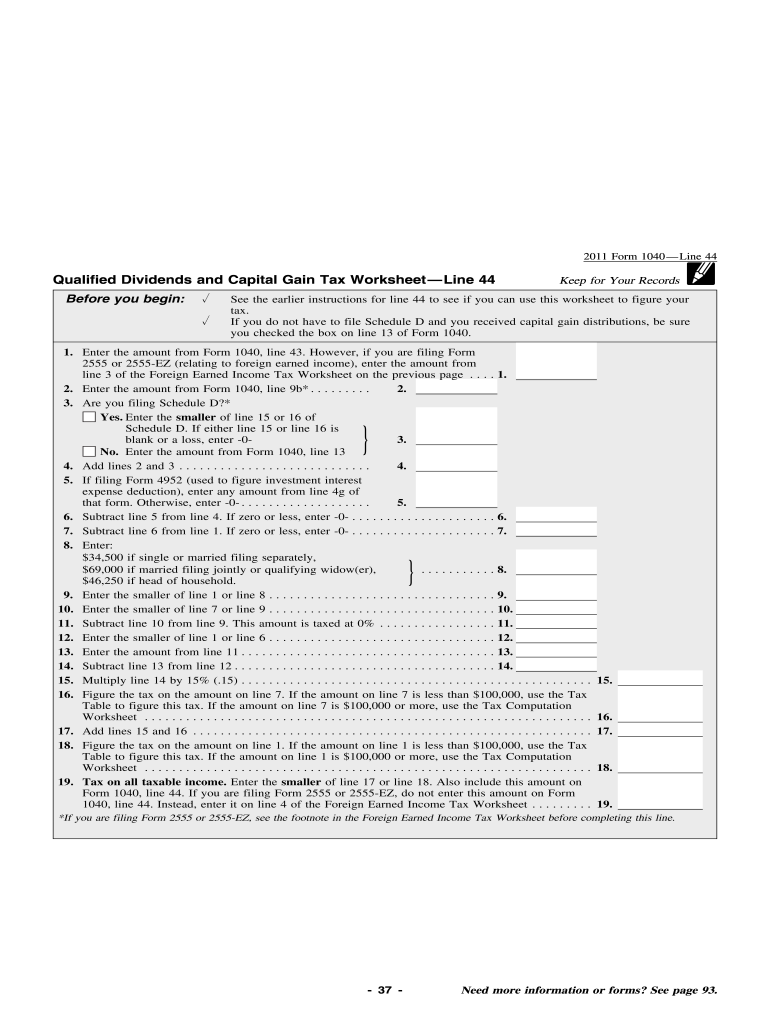

Capital gains tax on a primary home

The long-term capital gains tax rates are 15 percent, 20 percent and 28 percent (for certain special asset types, like small business stock collectibles), depending on your income. This means you may be able to meet the 2-year residence test even if, because of your service, you didn’t actually live in your home for at least the 2 years during the 5-year period ending on the date of sale. Make the election by filing your tax return for the year of the sale or exchange of your main home, and exclude the gain from your taxable income.

The term “net short-term capital loss” means the excess of short-term capital losses (including any unused short-term capital losses carried over from previous years) over short-term capital gains for the year. However, the IRS gives home sellers multiple ways to avoid or reduce their capital gains taxes, principally if their property is a primary residence. You can exempt a certain amount of the profit — up to $250,000 or $500,000, depending on your filing status — from the tax if you meet certain conditions.

How the home sale tax exemption works

You meet the requirements for a partial exclusion if any of the following events occurred during your time of ownership and residence in the home. If you meet the ownership, residence, and look-back requirements, taking the exceptions into account, then you meet the Eligibility Test. You need to determine whether that time counts toward your residence requirement. A vacation or other short absence counts as time you lived at home (even if you rented out your home while you were gone). We conform to the IRS rules and allow you to exclude, up to a certain amount, the gain you make on the sale of your home. You may take an exclusion if you owned and used the home for at least 2 out of 5 years.

Avoiding capital gains tax on a rental or additional property

If you sold the property, you would pay capital gains tax on that $200,000 difference in value rather than the full sale price of $500,000. As with any matter related to taxes, it’s best to speak with a professional tax expert so you can fully understand what you owe and what your options are. Homeowners can potentially offset capital gains on their home with realized capital losses on securities or other assets. This may be possible if you sell other assets at a loss in the same year you sell your home, or if you have losses from previous years that you've carried forward for tax purposes. If you're considering pursuing tax-loss harvesting by selling securities, be mindful of potential wash sales and make sure not to throw off your investment plan. Consider working with a financial professional to identify a tax-loss harvesting strategy that's consistent with your long-term investment goals.

What Is The Real Estate Gift Tax And How Can I Avoid It?

Even taxpayers in the top income tax bracket pay long-term capital gains rates that are nearly half of their income tax rates. That's why some high net worth Americans don't pay as much in taxes as you might expect. The amount you owe in capital gains taxes depends in part on how long you owned the asset. Long-term capital gains taxes are paid when you’ve held an asset for more than one year, and short-term capital gains apply to profits from an asset you’ve held for one year or less.

Frequently Asked Question Subcategories for Capital Gains, Losses, and Sale of Home

Go to IRS.gov/Forms to view, download, or print all the forms, instructions, and publications you may need. On IRS.gov, you can get up-to-date information on current events and changes in tax law.. If you aren’t itemizing deductions on your return for the year in which you sold your home, skip to Reporting Other Income Related to Your Home Sale, later. If ANY of the three bullets above is true, skip to Determine whether your home sale is an installment sale, later. If you completed “Business” and “Home” versions of your gain/loss worksheet as described in Property Used Partly for Business or Rental, earlier, complete this worksheet only for the “Home” version. For a step-by-step guide to determining whether your home sale qualifies for the maximum exclusion, see Does Your Home Sale Qualify for the Exclusion of Gain?

When you have built a low-cost, diversified portfolio and the assets being held are worth more than what you paid for them, you might consider selling some of those assets to realize those capital gains. Individuals, estates and trusts with income above specified levels own this tax on their net investment income. If you have net investment income from capital gains and other investment sources, and a modified adjusted gross income above the levels listed below, you will owe the tax. You earn a capital gain when you sell an investment or an asset for a profit. When you realize a capital gain, the proceeds are considered taxable income. The key idea to keep in mind here is that capital gains tax focuses on the appreciated value of an investment, not its total value.

Even if you have no plans to sell soon, try to keep track of money you invest in your home, particularly major remodeling or renovations. Joy is an experienced CPA and tax attorney with an L.L.M. in Taxation from New York University School of Law. After many years working for big law and accounting firms, Joy saw the light and now puts her education, legal experience and in-depth knowledge of federal tax law to use writing for Kiplinger. She writes and edits The Kiplinger Tax Letter and contributes federal tax and retirement stories to kiplinger.com and Kiplinger’s Retirement Report. Her articles have been picked up by the Washington Post and other media outlets. Joy has also appeared as a tax expert in newspapers, on television and on radio discussing federal tax developments.

Understanding Capital Gains - Next Avenue

Understanding Capital Gains.

Posted: Thu, 11 Jan 2024 08:00:00 GMT [source]

For tax purposes, these dates are calculated from the day after the original purchase to the date of sale of the property. This is considered a capital improvement because the renovation increases the overall value of your home. That’s $150,000 (the original purchase price) + $50,000 (the amount spent on the capital improvement). You should report your capital gains or losses on Schedule D of your Form 1040 and transfer the reportable amount to Line 13 of your Form 1040. As you can see, selling an investment property -- especially one you've held for a long time -- can result in quite a hefty tax bill. As a basic example, if you acquire a property for a $200,000 purchase price, pay $5,000 in acquisition expenses, and spend $20,000 to renovate the kitchen, your cost basis will be $225,000.

However, if you move your home from the land on which it stood (meaning you relocate the actual physical structure), then that land no longer counts as part of your home. For example, if you move a mobile home to a new lot and sell the old lot, then you can’t treat the sale of the old lot as the sale of your home. Together, the 10-year suspension period and the 5-year test period can be as long as, but no more than, 15 years. You can’t suspend the 5-year period for more than one property at a time. You can revoke your choice to suspend the 5-year period at any time. Go to IRS.gov/Forms to download current and prior-year forms, instructions, and publications.

No comments:

Post a Comment